News

Samsung led the global smartphone market in Q2 2021, Xiaomi’s remarkable growth made no impact!

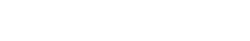

It’s mid-July and we’ve entered the third quarter of this year. Following this, market analysis firms started revealing the results of their research in which Canalys become the first. The company just published its records of global smartphone shipment in the second quarter of this year.

Of course, Samsung remained the leader of the global smartphone market with the highest volume of shipments in the second quarter. Meanwhile, the report suggests that the industry saw some noticeable and unexpected changes in terms of smartphone sales globally.

According to Canalys’ interesting report, Xiaomi overtakes Apple as the world’s second smartphone vendor with a massive 83% year-on-year growth. At the same time, the Chinese phone maker noticeably reduced the market share of Apple and grabbed 17% of the total.

Join Sammy Fans on Telegram

Talking specifically about Samsung, the company recorded 15% year-on-year growth and the highest 19% share of the global smartphone market in the second quarter of this year. It’s worth mentioning that the Korean phone maker still leading the world but Xiaomi has finally emerged as the major rival.

The Cupertino tech giant slipped to third with just 1% year-on-year growth and secured 14% of the market share. Followed by Oppo and Vivo with 10% market share and 28% YoY growth and 10% market share and 27% YoY growth respectively.

News

Samsung boosts HBM capabilities with new investments

Samsung has reportedly signed a contract valued at around $15 million to sell and purchase semiconductor equipment to expand HBM chip production facilities at its Suzhou plant in China.

BusinessKorea reports that Samsung is expanding its investments across HBM facilities. The company aims to strengthen its advanced semiconductor packaging to lead the supply chain.

Eying the HBM4 chip boom, the Korean tech giant is focusing on enhancing its packaging capabilities to secure future technological competitiveness and narrow the gap with SK Hynix.

KEDGlobal revealed that Tesla asked Samsung and SK Hynix to supply HBM4 samples. The US EV maker could choose either Samsung or SK Hynix as its HBM4 supplier after testing samples.

Pay attention, packaging includes the tech and processes for shaping semiconductor chips to fit the devices they will be mounted on – making it an important aspect of development and production.

Notably, the Suzhou China facility is currently Samsung’s test and packaging production base outside Korea. Increased investment is seen as a choice for innovation in packaging processes and production efficiency.

Apart from this, the company is also ramping up its packaging production bases in Korea. Samsung has recently signed an investment agreement with South Chungcheong Province and Cheonan City.

News

Samsung could get a major role in Tesla’s AI revolution

Tesla reportedly asked Samsung and SK Hynix to supply HBM4 chip samples. Both semiconductor firms are developing sixth-generation high-bandwidth memory chip prototypes for Tesla.

KEDGlobal reports that Tesla asked Samsung and SK Hynix to supply HBM4 chips for general use. It is expected to choose one of the two companies as its HBM4 supplier after testing their samples.

Using custom HBM4 chips made by Samsung and SK Hynix, Tesla seeks to enhance its artificial intelligence (AI) capabilities apart from reducing AI chip reliance on Nvidia.

Samsung is working hard to win Tesla orders for HMB4 chips. The company even working with Taiwan’s TSMC to foster its HBM chip’s development and maintain an edge over SK Hynix.

SK Hynix is also accelerating its development to maintain its leadership in the HBM space. The firm winning Tesla’s HMB orders would see a sharp push in the global memory supply chain.

Notably, the 6th-gen HBM4 chips are crucial for Tesla’s Dojo supercomputer, which is designed for training AI models and will also support its AI data centers and autonomous cars.

The HBM4 semiconductor offers notable enhancements over the previous generations, delivering up to 1.65 Tbps of bandwidth, 1.4 times faster than the HBM3E while consuming 30% less power.

News

Report: Samsung eyes 2nm Exynos 2600 to attract Qualcomm, Nvidia

Samsung Foundry wants to produce Exynos to attract 2nm clients like Qualcomm and Nvidia. Major chip designers have no option other than TSMC for contract semiconductor production.

Digitimes report suggests that Samsung Foundry wants to produce 2nm Exynos 2600 chipset. The company has recently started Exynos 2500’s mass production for Z Flip 7, Korean media reported.

TSMC is producing 3nm Snapdragon 8 Elite chips for Qualcomm. Nvidia also produces its most advanced semiconductors using TSMC’s cutting-edge process nodes.

The latest report indicates that Samsung Foundry is advancing its semiconductor capabilities. The mass production of Exynos 2600 is under consideration for next year.

Samsung Foundry has no other option but to prove its semiconductor capabilities. If the Foundry division manages to secure decent yield rates in the 2nm process, Qualcomm may ink a deal.

Exynos 2600 is a great opportunity to demonstrate the technological innovations of the Foundry division. It would attract key clients like Qualcomm, marking a strategic push for the business.

Samsung will have 2x benefit with the 2nm process technology. The Exynos 2600 would power the Galaxy S26 series – ending the reliance on Qualcomm for Snapdragon chipsets.

Qualcomm will also get the opportunity to negotiate production costs with TSMC. Samsung Foundry is comparatively cheaper than TSMC as there will be two major options for clients.

“Samsung Electronics’ foundry division is advancing its semiconductor capabilities through the mass production of the Exynos 2600 (tentative name), marking a strategic push for self-sufficiency in mobile application processors (APs).” – Digitimes.