Business

Samsung’s existence in flagship smartphone market declines in Q2 2021

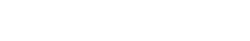

According to market researcher Counterpoint Research, the growth in the premium segment outpaced the overall market growth of 26% YoY. Besides, the premium segment share in the global smartphone sales increased to 24% in Q2 2021, compared to 21% in Q2 2020.

As per the report, Samsung’s share in the premium smartphone market declined in the second quarter of the year as Apple strengthens its leadership. Although Samsung’s sales in the premium segment have grown by 13% YoY, the product has lost its share in the segment due to production disruptions in the Vietnamese unit following the recent outbreak of COVID-19.

However, with the introduction of the new Z fold 3 and Z flip 3 models at a lower price compared to their predecessors, Samsung is likely to acquire a share in H2 2021.

Join Sammy Fans on Telegram

Where Apple continued to lead the segment, covering more than half of the sales over the quarter, followed by Samsung and Huawei. Since the launch of the iPhone 12 series in Q4 2020, Apple has continued to account for more than 50% of the premium smartphone market.

The South Korean tech giant has put a 17 percent stake in the premium market, with models priced at the US $400 or more, in April-June, down from 22 percent a year earlier.

Huawei Technologies’s share in the premium market has dropped to 6 percent from 17 percent a year earlier and shares third place with its Chinese rival Xiaomi Corp. The global premium smartphone market has seen annual sales growth of 46%, surpassing the overall smartphone market growth by 26 percent.

Counterpoint Research has added a premium share in global smartphone sales that increased to 24 percent in the second quarter, up from 21 percent last year.

Counterpoint Research says 5G is also a popular offering within the premium segment. Its data showed the total penetration of 5G devices within the premium market to 84 percent in the second quarter, up from 35 percent last year. For a price band of $600 and up, 95 percent of the devices were 5G support.

A market researcher predicted that the premium segment would grow further following the strong demand for high-end devices from Apple and Samsung.

Business

Samsung holds onto top spot but Apple, Xiaomi getting closer

Samsung remained the king in the Q2 2024 market, but Apple and Xiaomi are getting closer. IDC market research data shows that Samsung led the worldwide smartphone market in the second quarter of the year and Chinese brands scored rapid growth.

According to IDC, Samsung sold 53.9 million devices in the second quarter. The company occupied an 18.9% market share internationally. The company has slightly improved its sales share up from 53.5 million units in the same period last year.

The data suggests that Apple ranked second in terms of global volume sales. The iPhone maker shipped 45.2 million devices in Q2, 2024. It captured a market share of 15.8%, a modest increase from 44.5 million shipments in the second quarter of last year.

Third comes Xiaomi. The Chinese brand saw massive growth in sales year over year. It had sold 42.3 million smartphones in the second quarter alone. It’s a big jump from 33.2 million units shipped in Q2 2023, becoming a potential threat to Apple and Samsung.

Apart from this, Vivo also recorded significant growth in the global market. The company’s year-over-year growth in Q2 was 21.9%, with sales listing 25.9 million units with a market share of 9.1%. The growth percentage shows that aggressive marketing and boasting competitive specs into devices is paying off.

Samsung, Apple’s game isn’t over…

Last week, Samsung launched its new foldable phones, releasing on July 24, 2024. Apple, on the other hand, is expected to launch new flagship iPhones in September. It means, Samsung will enjoy the third quarter as well. The fourth quarter might be of Apple as iPhone sales would sharply grow in the global market given the new lineup release.

Samsung is now preparing to unveil new FE products later this year, followed by the S25 series in early next year. Chinese brands are expected to debut their latest flagships in the last quarter of this year, while Google Pixel phones are also coming in August.

Business

Samsung expects massive profit boom in Q2 given AI rise

Samsung today announced provisional sales and profit results for the second quarter. Samsung formally announced the provisional/predicted sales and operating profit, suggesting a massive profit boom in Q2, 2024 given the AI memory semiconductor rise.

In Q2, 2024, Samsung sales provisionally increased by 2.89% and operating profit by 57.34% compared to the previous quarter thanks to AI boom. Besides, the sales climbed by 23.31% and operating profit by 1,452.24% compared to the same period last year.

The company expects sales of 74 trillion won and operating profit of 10.4 trillion won on a consolidated basis. While these results are not final, there won’t be much change in the final result when it comes out. Samsung had a pretty profitable period in the second quarter.

Samsung in Q2

- Consolidated Sales: Approximately 74 trillion Korean won

- Consolidated Operating Profit: Approximately 10.4 trillion Korean won

The Korean tech giant is currently facing yield issues in its second-generation 3nm process. The flagship Exynos processor is unlikely to be commercialized this year. It would lead the Mobile business to face additional burdens due to rising prices of Snapdragon chipsets.

Meanwhile, Samsung is focussing on HBM (high bandwidth memory) semiconductors. HBM is a key player in artificial intelligence servers and data centers. The booming AI market will directly benefit Samsung’s semiconductor business.

Business

Samsung leads Q3 smartphone market, Huawei’s entry haunts Apple

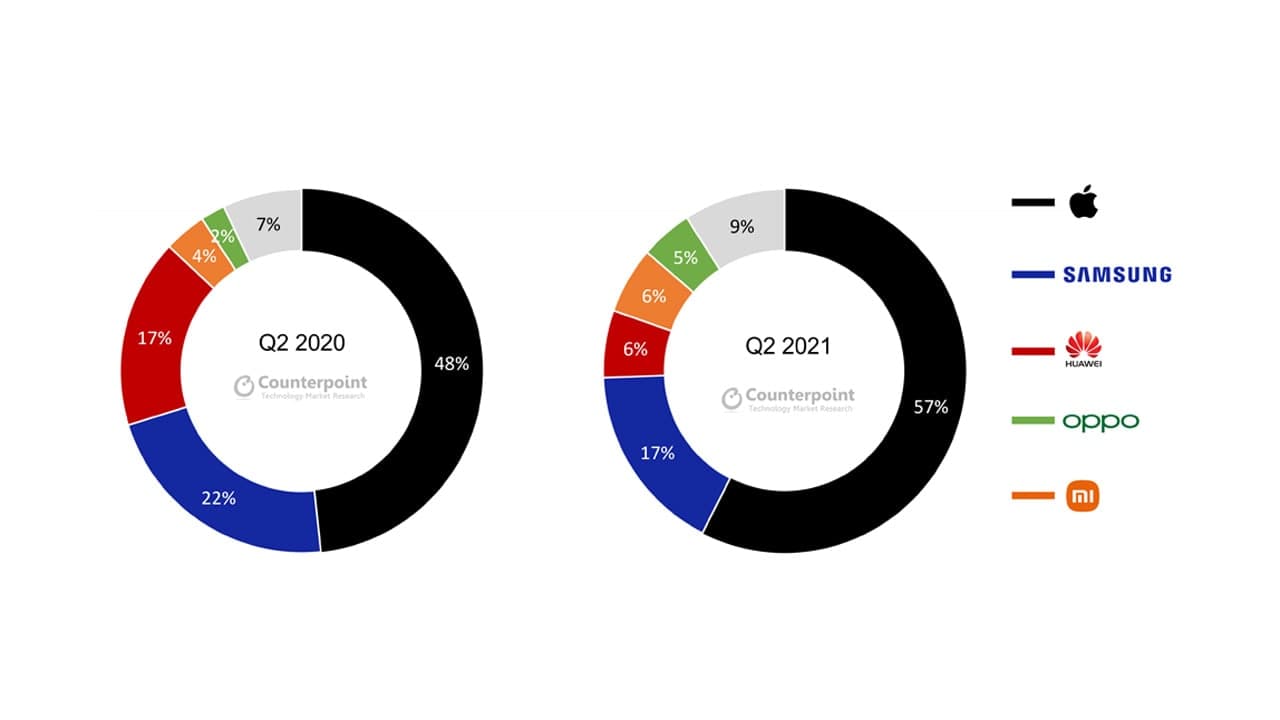

Samsung ranked first in market share in the global smartphone market in Q3, 2023. TrendForce report says that Samsung led the global Q3 smartphone market, recording a market share of 19.5%.

Overall production in the third quarter increased by 11.5% compared to the previous quarter to 60.1 million units. During the same period, Apple’s production increased by 17.9% to 49.5 million, thanks to iPhone 15.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

Third place was taken by Xiaomi (13.9%), followed by Oppo (12.6%) and Transion (8.6%). 6th place is Vivo (8%). Meanwhile, global smartphone production reached 308 million units, a 13% increase compared to the previous quarter and a 6.4% increase from the previous year.

Huawei’s re-entry into the flagship smartphone market targeting Apple has had a significant impact in China. Huawei is aiming to expand its high-end flagship series, focusing on the Chinese domestic market next year, so Apple “We plan to attack directly”.

// Source