Business

Samsung Display begins importing A4-2 sixth-gen OLED plant equipment

Samsung has started supplying display processing equipment to Asan’s sixth-generation organic light-emitting diode (OLED) plant ‘A4-2’. The investment has won a total of nearly 1 trillion won and is expected to hurt the performance equipment industry.

According to the report, the A4-2 line of Samsung Display is intended to replace the LCD factory (L7-2), which was converted to the 6th generation OLED production line earlier last year. It is expected to start operations quickly in the third quarter.

Since bringing in some equipment from the first quarter of this year, line construction has been very fast. With the manufacture of this OLED line, Samsung Display achieves an additional 180,000 annual production capacity for sixth-generation OLED panels.

Samsung A4-2 plant is a complementary investment rather than a new expansion. It is an investment to address production capacity imbalances that have arisen while implementing new technologies at the A3 and A4 of Samsung Display’s sixth-generation OLED plants.

Samsung Display has begun processing touch-integrated and low-temperature polycrystalline oxide (LTPO) in its A3 and A4 factories. Due to this, the current sixth-generation OLED production capacity is partially reduced.

Samsung Display’s A4-2 plant also has the space and space to achieve an additional production capacity of 180,000 sheets per year. If additional orders are placed, large-scale equipment orders similar to this subsidiary investment will follow.

Samsung Display responds to mobile OLED demand and decides whether to make additional investments in line with market conditions. Some display device manufacturers are also preparing to invest in Samsung Display’s A5 plant. Samsung Display has not yet confirmed the factory specifications.

Get notified –

Aside from SammyFans’ official Twitter and Facebook page, you can also join our Telegram channel, follow us on Instagram and subscribe to our YouTube channel to get notified of every latest development in Samsung and One UI ecosystem. Also, you can follow us on Google News for regular updates.

Business

Samsung holds onto top spot but Apple, Xiaomi getting closer

Samsung remained the king in the Q2 2024 market, but Apple and Xiaomi are getting closer. IDC market research data shows that Samsung led the worldwide smartphone market in the second quarter of the year and Chinese brands scored rapid growth.

According to IDC, Samsung sold 53.9 million devices in the second quarter. The company occupied an 18.9% market share internationally. The company has slightly improved its sales share up from 53.5 million units in the same period last year.

The data suggests that Apple ranked second in terms of global volume sales. The iPhone maker shipped 45.2 million devices in Q2, 2024. It captured a market share of 15.8%, a modest increase from 44.5 million shipments in the second quarter of last year.

Third comes Xiaomi. The Chinese brand saw massive growth in sales year over year. It had sold 42.3 million smartphones in the second quarter alone. It’s a big jump from 33.2 million units shipped in Q2 2023, becoming a potential threat to Apple and Samsung.

Apart from this, Vivo also recorded significant growth in the global market. The company’s year-over-year growth in Q2 was 21.9%, with sales listing 25.9 million units with a market share of 9.1%. The growth percentage shows that aggressive marketing and boasting competitive specs into devices is paying off.

Samsung, Apple’s game isn’t over…

Last week, Samsung launched its new foldable phones, releasing on July 24, 2024. Apple, on the other hand, is expected to launch new flagship iPhones in September. It means, Samsung will enjoy the third quarter as well. The fourth quarter might be of Apple as iPhone sales would sharply grow in the global market given the new lineup release.

Samsung is now preparing to unveil new FE products later this year, followed by the S25 series in early next year. Chinese brands are expected to debut their latest flagships in the last quarter of this year, while Google Pixel phones are also coming in August.

Business

Samsung expects massive profit boom in Q2 given AI rise

Samsung today announced provisional sales and profit results for the second quarter. Samsung formally announced the provisional/predicted sales and operating profit, suggesting a massive profit boom in Q2, 2024 given the AI memory semiconductor rise.

In Q2, 2024, Samsung sales provisionally increased by 2.89% and operating profit by 57.34% compared to the previous quarter thanks to AI boom. Besides, the sales climbed by 23.31% and operating profit by 1,452.24% compared to the same period last year.

The company expects sales of 74 trillion won and operating profit of 10.4 trillion won on a consolidated basis. While these results are not final, there won’t be much change in the final result when it comes out. Samsung had a pretty profitable period in the second quarter.

Samsung in Q2

- Consolidated Sales: Approximately 74 trillion Korean won

- Consolidated Operating Profit: Approximately 10.4 trillion Korean won

The Korean tech giant is currently facing yield issues in its second-generation 3nm process. The flagship Exynos processor is unlikely to be commercialized this year. It would lead the Mobile business to face additional burdens due to rising prices of Snapdragon chipsets.

Meanwhile, Samsung is focussing on HBM (high bandwidth memory) semiconductors. HBM is a key player in artificial intelligence servers and data centers. The booming AI market will directly benefit Samsung’s semiconductor business.

Business

Samsung leads Q3 smartphone market, Huawei’s entry haunts Apple

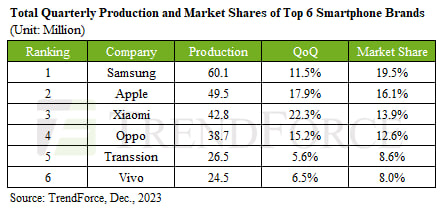

Samsung ranked first in market share in the global smartphone market in Q3, 2023. TrendForce report says that Samsung led the global Q3 smartphone market, recording a market share of 19.5%.

Overall production in the third quarter increased by 11.5% compared to the previous quarter to 60.1 million units. During the same period, Apple’s production increased by 17.9% to 49.5 million, thanks to iPhone 15.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

Third place was taken by Xiaomi (13.9%), followed by Oppo (12.6%) and Transion (8.6%). 6th place is Vivo (8%). Meanwhile, global smartphone production reached 308 million units, a 13% increase compared to the previous quarter and a 6.4% increase from the previous year.

Huawei’s re-entry into the flagship smartphone market targeting Apple has had a significant impact in China. Huawei is aiming to expand its high-end flagship series, focusing on the Chinese domestic market next year, so Apple “We plan to attack directly”.

// Source