Business

Samsung faces tear-jerking profit sink

Today, Samsung officially declared its consolidated Q4 2022 results of KRW 70.46 trillion in sales and KRW 4.31 trillion in operating profit. Compared to Q3, Samsung Elec reported an 8.2% fall in profit with 70.46 trillion won in sales, however, sales continued to record a record high on an annual basis.

First comes, the Device eXperience (DX Division), which reported sales of 42.71 trillion won and an operating profit of 1.64 trillion won in the fourth quarter. Second, the MD Division saw both sales and profits decline due to slowing smartphone sales and weak demand in the mid-price market.

Follow Sammy Fans on Google News

Further, the company disclosed that the Device Solutions (DS Division) recorded sales of 20.07 trillion won and an operating profit of 0.27 trillion won in 4Q22. Earnings of the memory business declined significantly as the price fell sharply due to customers’ continued inventory adjustments.

Join Sammy Fans on Telegram

Samsung System LSI’s revenues sink because of sluggish sales of major products due to inventory adjustments in the industry. However, the foundry business recorded the highest quarterly and annual sales by expanding sales for major customers and increased profits year-on-year by expanding production capacity.

SDC: Samsung’s SDC business registered KRW 9.31 trillion in sales and KRW 1.82 trillion in operating profit. Since earnings for the small and medium-sized segments decreased QoQ, solid performance was achieved thanks to sales focused on flagship products such as QD-OLED for TVs.

Plans for Q1 2023

- Memory

-

- Plans to expand preparations to meet demand for DDR5 for servers and PCs

- Actively responding to demand for mobile high-capacity products such as LPDDR5x

- System LSI

- Expand sales of mid-to-low-priced SoC (System on Chip)

- Expand sales of 200MP image sensors

- Expand the supply of SoC for vehicles to European premium OEMs and self-driving products.

- SDC

- Actively respond to the demand for new products in the case of small and medium-sized TVs

- Securing additional demand for large screens by launching new super-large TVs and large-sized monitors.

- MX

- Expand sales of flagships such as Galaxy S23 and continue to strengthen sales of premium tablets and wearable products

- Network

- Focus on responding to new businesses

- Strengthening global business base in North America as well as South Korea

- Foundry

- Increase new customer orders for the 2nd-generation 3nm process based on its competitiveness in the next-generation GAA process

- Strengthening its technological competitiveness by focusing on the development of the 1st-generation 2nm process

Read More:

Apple won the battle but Samsung won the war of 2022 smartphone market

Samsung knocks all smartphone rivals off their perch, Apple too!

Business

Samsung holds onto top spot but Apple, Xiaomi getting closer

Samsung remained the king in the Q2 2024 market, but Apple and Xiaomi are getting closer. IDC market research data shows that Samsung led the worldwide smartphone market in the second quarter of the year and Chinese brands scored rapid growth.

According to IDC, Samsung sold 53.9 million devices in the second quarter. The company occupied an 18.9% market share internationally. The company has slightly improved its sales share up from 53.5 million units in the same period last year.

The data suggests that Apple ranked second in terms of global volume sales. The iPhone maker shipped 45.2 million devices in Q2, 2024. It captured a market share of 15.8%, a modest increase from 44.5 million shipments in the second quarter of last year.

Third comes Xiaomi. The Chinese brand saw massive growth in sales year over year. It had sold 42.3 million smartphones in the second quarter alone. It’s a big jump from 33.2 million units shipped in Q2 2023, becoming a potential threat to Apple and Samsung.

Apart from this, Vivo also recorded significant growth in the global market. The company’s year-over-year growth in Q2 was 21.9%, with sales listing 25.9 million units with a market share of 9.1%. The growth percentage shows that aggressive marketing and boasting competitive specs into devices is paying off.

Samsung, Apple’s game isn’t over…

Last week, Samsung launched its new foldable phones, releasing on July 24, 2024. Apple, on the other hand, is expected to launch new flagship iPhones in September. It means, Samsung will enjoy the third quarter as well. The fourth quarter might be of Apple as iPhone sales would sharply grow in the global market given the new lineup release.

Samsung is now preparing to unveil new FE products later this year, followed by the S25 series in early next year. Chinese brands are expected to debut their latest flagships in the last quarter of this year, while Google Pixel phones are also coming in August.

Business

Samsung expects massive profit boom in Q2 given AI rise

Samsung today announced provisional sales and profit results for the second quarter. Samsung formally announced the provisional/predicted sales and operating profit, suggesting a massive profit boom in Q2, 2024 given the AI memory semiconductor rise.

In Q2, 2024, Samsung sales provisionally increased by 2.89% and operating profit by 57.34% compared to the previous quarter thanks to AI boom. Besides, the sales climbed by 23.31% and operating profit by 1,452.24% compared to the same period last year.

The company expects sales of 74 trillion won and operating profit of 10.4 trillion won on a consolidated basis. While these results are not final, there won’t be much change in the final result when it comes out. Samsung had a pretty profitable period in the second quarter.

Samsung in Q2

- Consolidated Sales: Approximately 74 trillion Korean won

- Consolidated Operating Profit: Approximately 10.4 trillion Korean won

The Korean tech giant is currently facing yield issues in its second-generation 3nm process. The flagship Exynos processor is unlikely to be commercialized this year. It would lead the Mobile business to face additional burdens due to rising prices of Snapdragon chipsets.

Meanwhile, Samsung is focussing on HBM (high bandwidth memory) semiconductors. HBM is a key player in artificial intelligence servers and data centers. The booming AI market will directly benefit Samsung’s semiconductor business.

Business

Samsung leads Q3 smartphone market, Huawei’s entry haunts Apple

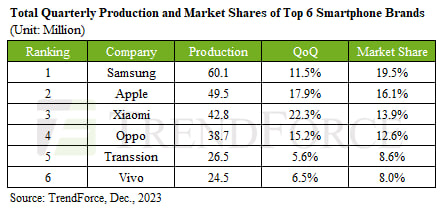

Samsung ranked first in market share in the global smartphone market in Q3, 2023. TrendForce report says that Samsung led the global Q3 smartphone market, recording a market share of 19.5%.

Overall production in the third quarter increased by 11.5% compared to the previous quarter to 60.1 million units. During the same period, Apple’s production increased by 17.9% to 49.5 million, thanks to iPhone 15.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

Third place was taken by Xiaomi (13.9%), followed by Oppo (12.6%) and Transion (8.6%). 6th place is Vivo (8%). Meanwhile, global smartphone production reached 308 million units, a 13% increase compared to the previous quarter and a 6.4% increase from the previous year.

Huawei’s re-entry into the flagship smartphone market targeting Apple has had a significant impact in China. Huawei is aiming to expand its high-end flagship series, focusing on the Chinese domestic market next year, so Apple “We plan to attack directly”.

// Source