News

OLED display race intensifies as Samsung kicks out BOE

Samsung dropped BOE from its OLED display supply chain. The company has diversified the panel suppliers, assigning OLED display supply to China’s Visionox and Tianma, bringing BEO orders to zero this year.

According to TheElec, Samsung will source OLED display from China’s Visionox and Tianma rather than BOE this year. BOE’s fallout is a result of legal disputes, leading Samsung Elec to favor Samsung Display by boycotting BOE.

Key Takeaways:

- Samsung’s smartphone OLED demand for 2024 was estimated at 163.2 million units.

- Samsung Display’s volume is absolute, with 159 million units (97%).

- Next is CSOT with 2.2 million units.

- Visionox and Tianma with 1 million units each.

- There is no volume from BOE.

Flagship Galaxy devices will continue to feature OLED displays supplied by Samsung Display. Chinese vendors will supply panels for Samsung’s low-cost devices, mostly belonging to the Galaxy M series.

BOE and Samsung had a patent dispute in the US and China. The legal battles soured relations, resulting in BOE’s OLED supplied to Samsung decreasing from 1.1 million units in 2022 to 600,000 units in 2023, and there is none this year.

The global mobile OLED shipment forecast for 2024 is 753.2 million units. Samsung Display has the most with 327 million units. Its clients are Samsung Electronics, Apple, Xiaomi, Oppo, Vivo, Google, Sony, and others.

News

Samsung teases Knowledge Graphs integration with Galaxy AI

Samsung’s Dae-Hyun Kim just teased Knowledge Graphs integration with Galaxy AI. The official published a contributed article on Samsung Newsroom, revealing plans for Generative AI innovation and evolution.

Kim talked about Samsung’s plans to develop Knowledge Graphs, which could be integrated with Galaxy AI and Generative AI features. This organic connection with GenAI will provide users with customized services across products.

Galaxy AI x Knowledge Graphs

Knowledge Graph is one of the key technologies for personalized AI. The organic integration with GenAI will ensure “customized services” for users. However, Samsung will continue to adopt the hybrid AI approach in the future further.

The Korean tech giant is currently discovering and optimizing generative AI functions that make products and services more useful. Galaxy AI is a hit, which is available across Samsung’s mobile products including phones, tablets, and wearables.

Additionally, Samsung plans to offer even more epic experiences through generative AI that could create unique results based on user needs. The current approach is to only process and analyze data to offer relevant suggestions.

Hybrid AI will grow further

Hybrid AI is a suite of functions that leverages both on-device and cloud AI technologies. On-device AI ensures fast response speed and strong personal data protection, while Cloud AI provides a variety of functions.

Galaxy AI is designed to use both on-device and cloud AI environments separately or simultaneously, depending on the technical requirements. It is available on several Galaxy flagship phones, tablets, and foldables.

AI and Security Together

Samsung prioritizes personal data protection and security in AI development. The company remains committed to the protection of user data while fostering efforts on the democratization of AI across products.

News

Report: Samsung’s 3nm (Exynos 2500) yield is extremely low (below 20%)

Samsung’s 3nm yield is extremely low, far below the mass production threshold. A new report says that the company’s 3-nanometer process yield is below 20%. Samsung may not be able to approve mass production of Exynos 2500 at this yield rate.

According to NewsWay (via Jukanlosreve), Samsung’s 3nm foundry process has a yield of less than 20%. The foundry division could not be able to attract new contract manufacturing clients, also retaining the existing ones has become a nearly impossible task.

Due to the low yield in the 3-nanometer foundry process, customers may have been disappointed. As a result, insisting on using only Samsung’s foundry would have made it harder to retain customers even the memory chip clients.

Exynos 2500

During the Exynos 2400 debut, Samsung confirmed the Exynos 2500 will be manufactured using a 3nm process node. As the yield rate is such low, the Foundry could not be able to win orders from System LSI and Samsung Elec.

It’s a win-win for TSMC as Samsung Foundry would shrink further and increased Snapdragon orders would help it widen the gap further. Qualcomm profits will also increase given Snapdragon exclusivity in the Galaxy S25 series.

Samsung Galaxy S25 to stick with Snapdragon 8 Elite despite Exynos 2500 benchmark

Foundry Spin-off

Recently, reports were revealing Samsung’s plans to spin off the Foundry business. The company’s Foundry could split from Samsung Elec. The new firm will focus on attracting contracts from leading semiconductor designers.

It is observed that major chip designers avoid Samsung Foundry due to exposure of trade secrets as System LSI also designs system chips for the Galaxy smartphones that Samsung Electronics produces through Samsung Foundry.

News

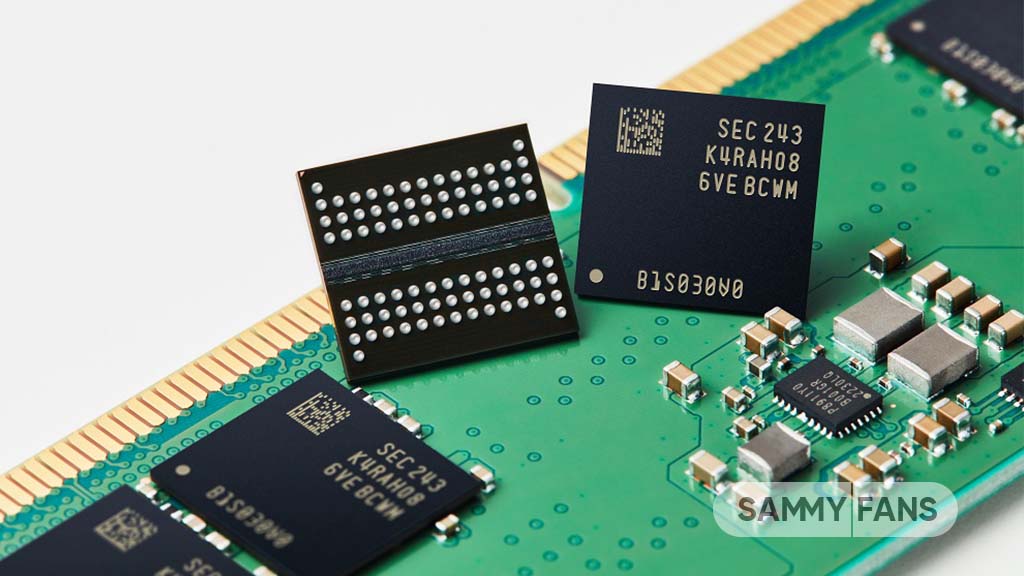

Samsung shifts strategy to combat Chinese DRAM surge

Samsung restructures DRAM (memory) business to tackle intensifying Chinese memory chip surge. The company is reportedly revisiting its strategy amid growing competition from Chinese memory chipmakers and contract manufacturers.

Chosun reports that Samsung facing significant competition in the DRAM business. Chinese vendors aggressively enter the areas that are unaffected by the US sanctions. The company had to rethink its strategy to combat the Chinese surge surge.

Samsung’s DS Division head is tackling these challenges. The division is preparing for a potential workforce and organizational restructuring by the year-end. DS Division could scale back production of legacy DRAM and 8-inch foundry segment.

It’s worth noting that Chinese chip makers eyeing gains in areas such as legacy chips used in automobiles, aircraft, home appliances, and consumer electronics. The Q3 performance had taken a hit from weaker-than-expected memory chip demand.

Apart from this, Samsung Foundry is also adjusting course by reassigning workers from the 8-inch foundry line at its production facility in Giheung, Gyeonggi, where utilization rates have also been significantly lowered.

At the recent earnings call, Samsung acknowledged its profitability has taken a hit due to the influx of Chinese DRAM. South Korea’s SK Hynix has also indirectly mentioned the pressures posed by increased Chinese DRAM supply.